The State of the GPU: Pricing Update Q1 2025

Well… the GPU market is pretty messed up at the moment. No stock of the cards people actually want to buy, inflated prices when models do become available, and plenty of allegations of fake MSRPs. So what on earth is going on? Why are prices so high? Do GeForce RTX 50 and Radeon RX 9000 series GPUs actually have fake MSRPs? Where do things stand right now? That's exactly what we'll be exploring in this GPU pricing update.

As a quick recap on the current state of the market: There have been six new graphics card releases so far in 2025 – four from Nvidia and two from AMD.

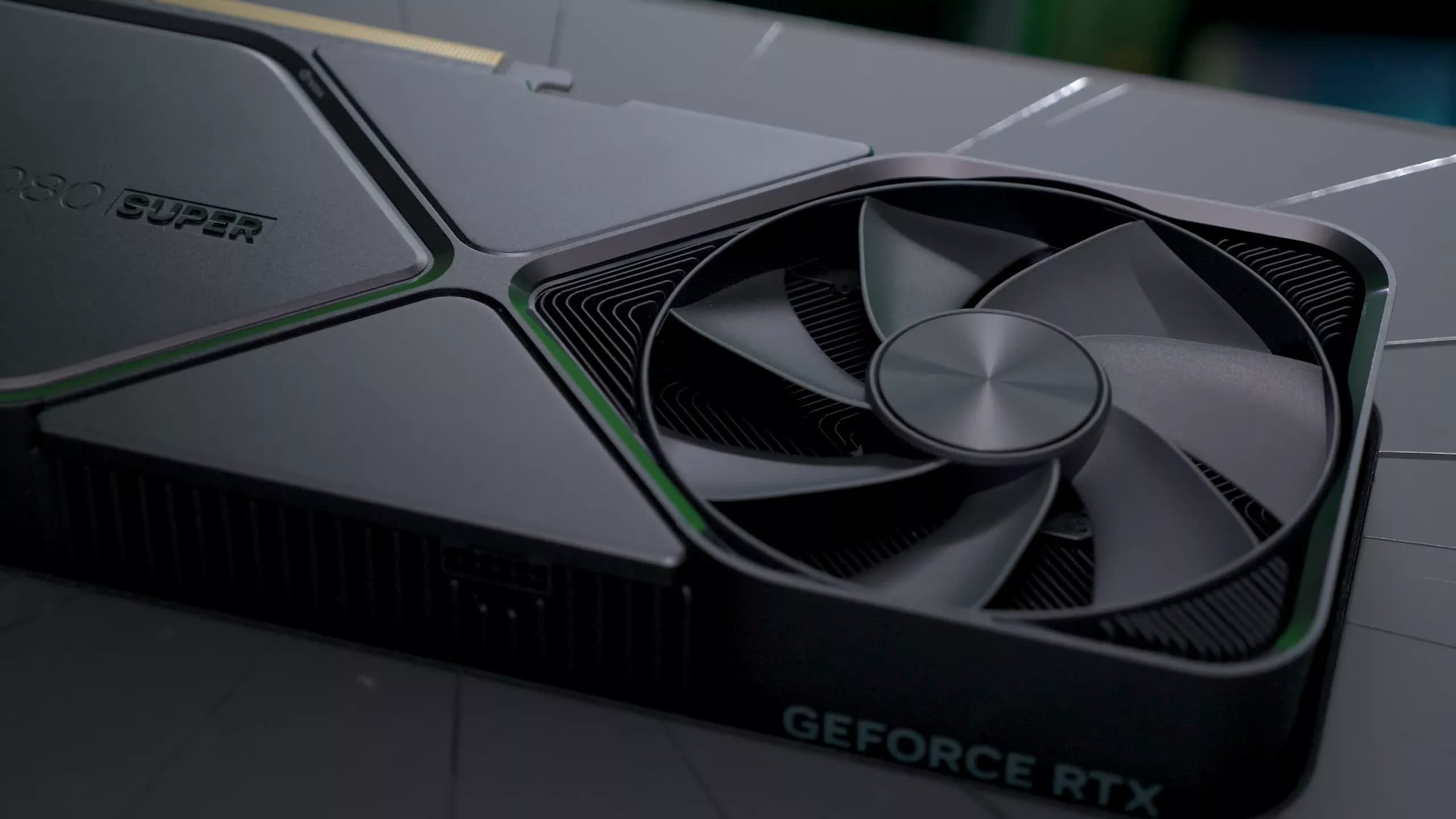

Nvidia's new RTX 50 GPUs launched with announced prices ranging from $550 to $2,000, but upon release, these cards were extremely scarce, often completely unavailable at MSRP and typically priced at least 20% higher – selling out even at that inflated price.

AMD launched two new Radeon models at $550 and $600, and while their supply was stronger than Nvidia's at launch, MSRP models were still limited. The average price for a premium AIB model was significantly higher. Some retailers have even raised prices upon receiving restocks – or worse, during release day – further hurting consumers.

The first thing we want to address is why pricing and availability have been so poor, or at least provide some insights based on conversations with various people in the supply chain. This is a highly complex issue with many contributing factors, but we'll do our best to piece it all together.

Understanding what happened pre-launch

The first factor affecting the entire GPU market leading up to these launches was the premature discontinuation of previous-gen models. Both AMD and Nvidia initially planned to launch their new graphics cards earlier. As of mid-2024, the GeForce 50 series was expected to launch around November 2024, while RDNA 4 was set for January 2025. However, both launches were delayed – Nvidia to January and AMD to March.

By the time these launches were pushed back, efforts were already underway to clear out existing inventory in preparation for the original launch schedule. In late 2024, reports surfaced of GeForce 40 series models being discontinued and selling out around November and December – timed to align with the expected new GPU launches. A similar situation occurred with AMD.

With the launches delayed, this process drained the market of GPU supply. For several months, anyone looking to buy a graphics card at certain price points – especially in the mid-range and above – had very few options. By the time the new graphics cards finally launched, this created a sense of scarcity, fueling FOMO and driving demand even higher. While this scarcity was not necessarily intentional, it was largely the result of unfortunate timing.

AMD GPU retailer rebates, how does it work?

As for the AMD RDNA 4 launch and why pricing was far from ideal, multiple factors were at play. Based on our understanding, board partners began producing the Radeon 9070 XT and RX 9070 in late 2024 for the original January launch, with cards being sold to retailers who stockpiled them in warehouses. Both AIBs purchasing GPU dies from AMD and retailers purchasing finished cards from AIBs were operating under early target prices. While payment structures vary, money was exchanged with the expectation of a certain price point.

This system typically works by setting the early target price at the upper end of AMD's expected MSRP range. If the final announced price is lower than what AIBs, distributors, and retailers anticipated, AMD provides rebates to the supply chain.

These rebates come in different forms, but the most common method is direct reimbursement to retailers. Retailers initially pay a higher price to stockpile the cards, then AMD refunds the difference, allowing the cards to be sold at the announced MSRP. There are often conditions tied to these rebates – for example, full rebates may only be granted if a certain percentage of stock is sold – creating incentives for retailers to promote the models. Some retailers receive these rebates as marketing development funds (MDF), but the goal remains the same: ensuring the cards reach the announced price.

Another rebate method involves compensating AIBs directly. If AIBs initially purchased GPU dies from AMD at a higher price, they receive rebates so that when they sell cards to retailers, the models can hit the advertised MSRP without AIBs taking a loss. However, AMD seems to prefer rebating retailers, as this approach provides additional marketing benefits that might not come from rebating AIBs directly.

With the RDNA 4 launch, the early target price for the cards was quite high. While we don't have an exact figure, retailers we spoke to expected the Radeon 9070 XT to be priced around $700. To actually sell the cards at the $600 MSRP, AMD would need to provide roughly a $100 rebate per unit. This process is fairly standard behind the scenes – retailers report their stock levels, and AMD issues a lump-sum rebate accordingly.

The main reason we've heard for the variability in RDNA 4 pricing – and why some regions have been hit with significantly worse prices than others – is that AMD has allegedly been selective with rebates. Here's an example of how this might work using theoretical numbers:

Let's say a brand offers three variants of the 9070 XT: a base card targeting the MSRP, a mid-range model, and a premium OC model. These cards were sold to retailers in January based on an early target price of, say, $700. That means the base card would be $700, the mid-range model $750, and the premium model $800 – a fairly standard 14% premium for the flagship card.

Then AMD announces that the official price is actually $600. To hit the MSRP and maintain logical pricing across all models, AMD would need to rebate all cards by $100 per unit. This would lower the base card to $600, the mid-range to $650, and the premium to $700. Ideally, this is how the system should work. However, if AMD is selective and only rebates the base model, the base card drops to $600, while the mid-range card stays at $750 and the premium card at $800. Since those higher-end models didn't receive a rebate, retailers – who purchased and stockpiled them months ago at the original price – are left selling them at the higher cost.

This is essentially what has happened.

Ready to ship to happy customers pic.twitter.com/ih1rdend8S – Adrian Thompson (@SAPPHIRE_Adrian) March 4, 2025

For example, OCUK publicly stated they had thousands of RDNA 4 cards in stock but that the "MSRP is capped at a quantity of a few hundred." Based on discussions with retailers, this likely occurred because the rebate was limited and didn't apply to all models. Microcenter, for instance, appears to have received a broader MSRP rebate than European and Australian retailers, who have struggled to reach MSRP pricing for many models.

This is the main reason you may have seen prices increase for base models and other variants on launch day. Once a retailer sells enough cards to match their allocated AMD rebate, they have to raise prices to avoid selling at a loss.

This is the main reason you may have seen prices increase for base models and other variants on launch day. Once a retailer sells enough cards to match their allocated AMD rebate, they have to raise prices to avoid selling at a loss. This also likely explains why some retailers canceled orders after they were placed – because they received further clarification on their rebate amount (which is often uncertain before launch) and couldn't fulfill the orders at the original price.

This situation has frustrated both retailers and AIBs. Retailers are frustrated by the rebate amount and the uncertainty surrounding how many units will receive rebates per shipment. AIBs are frustrated because they have already produced and sold the cards to retailers, expecting AMD to provide rebates at an appropriate level. Since AMD hasn't rebated AIBs directly for the GPU dies they purchased and used, AIBs are unable to lower prices themselves.

Of course, this is only part of the explanation. When there is high demand around a launch, there's less incentive to sell cards at a reasonable price and plenty of motivation to scalp and maximize profits. This can happen at all levels of the supply chain – retailers, distributors, and AIBs – and the extent of this behavior varies depending on the company, the retailer, and the region.

So while we've received information from multiple sources about what happened, it doesn't rule out questionable pricing tactics. Some entities may have preemptively raised prices to offset an expected rebate, increased prices under the guise of high demand, or forced retailers into unfavorable bundle deals. The list goes on. Just because selective rebating played a role at launch doesn't mean it will remain the sole reason for high prices moving forward.

Why are prices still bad right now?

So what about post-launch? Why are prices still high? Right now, there is a period of uncertainty, and it's too early to call the RDNA 4 MSRP fake. This is due to several factors, the primary one being that shipments arriving at retailers in the weeks after launch were arranged beforehand under the system we just described.

It takes time to ship GPUs. With the initial wave of rebates already used up, when these pre-arranged shipments arrive, retailers are unable to offer them at MSRP because they weren't purchased at that price. They might be rebated, but there's uncertainty around whether that will happen, so most retailers aren't selling those cards at MSRP.

This is why, if you check Newegg right now, you'll see base 9070 XT models like the PowerColor Reaper listed at $700 instead of the $600 MSRP, and the Asrock Steel Legend at $670. List prices have increased because those prices reflect incoming shipments that were purchased at higher costs.

Another factor is that AMD announced the price very close to launch – just a week beforehand – and the final price was significantly different from initial expectations. You may have noticed the dubbing over the pricing sections in AMD's announcement video, indicating that AMD was still finalizing the price just days before the reveal. If the price difference had been only $20 – 50, it would have taken less time for that adjustment to ripple through shipments. In that case, rebates would have been smaller and less disruptive.

AMD's RDNA 4 could go one of two ways... The good path – the one we hope for – is that AMD is already selling GPUs to AIBs at a price that allows the $600 MSRP to be met. Once those units are shipped to retailers, they would be available at MSRP without requiring additional rebates. In the period between launch and those shipments arriving, prices might not be ideal, but they would stabilize within a month or so.

The bad path is if little to no effort is made to bring prices down. For example, if AMD doesn't sell GPUs to AIBs at a price that allows for MSRP pricing and instead continues relying on selective rebates, MSRP supply will remain limited. Alternatively, if AIBs and retailers receive GPUs at lower prices but choose to mark them up due to high demand. Under these conditions, it would be reasonable to call the MSRP fake.

At this stage, it could go either way. People we've spoken to in the industry also don't know whether future shipments will be priced competitively, only that current shipments are arriving at higher-than-MSRP prices. Yes, it seems like AMD could have done more to ensure better GPU pricing at launch and in the weeks that followed. However, if prices return to MSRP within a month or two, this wouldn't be much different from other graphics card launches where demand initially outstrips supply – meaning it wouldn't necessarily indicate a fake MSRP.

For what it's worth, AMD's official statement claims that MSRP models will be available beyond launch and suggests they are working to maintain that pricing. The statement, from Frank Azor, reads: "It is inaccurate that $549/$599 MSRP is launch-only pricing. We expect cards to be available from multiple vendors at $549/$599 (excluding tariffs/taxes) based on the work we have done with our AIB partners, and more are coming. At the same time, the AIBs have different premium configurations at higher price points and those will also continue."

Whether or not this is true remains to be seen.

What about GeForce?

With Nvidia GeForce GPUs, we're dealing with a different situation. Instead of a launch where retailers stockpiled graphics cards well in advance of the official pricing announcement, we're seeing the opposite. Nvidia revealed the GeForce 50 series long before launch, announced pricing for all models, and even allowed RTX 5090 reviews a week ahead of release – yet failed to supply the market with anywhere near enough cards.

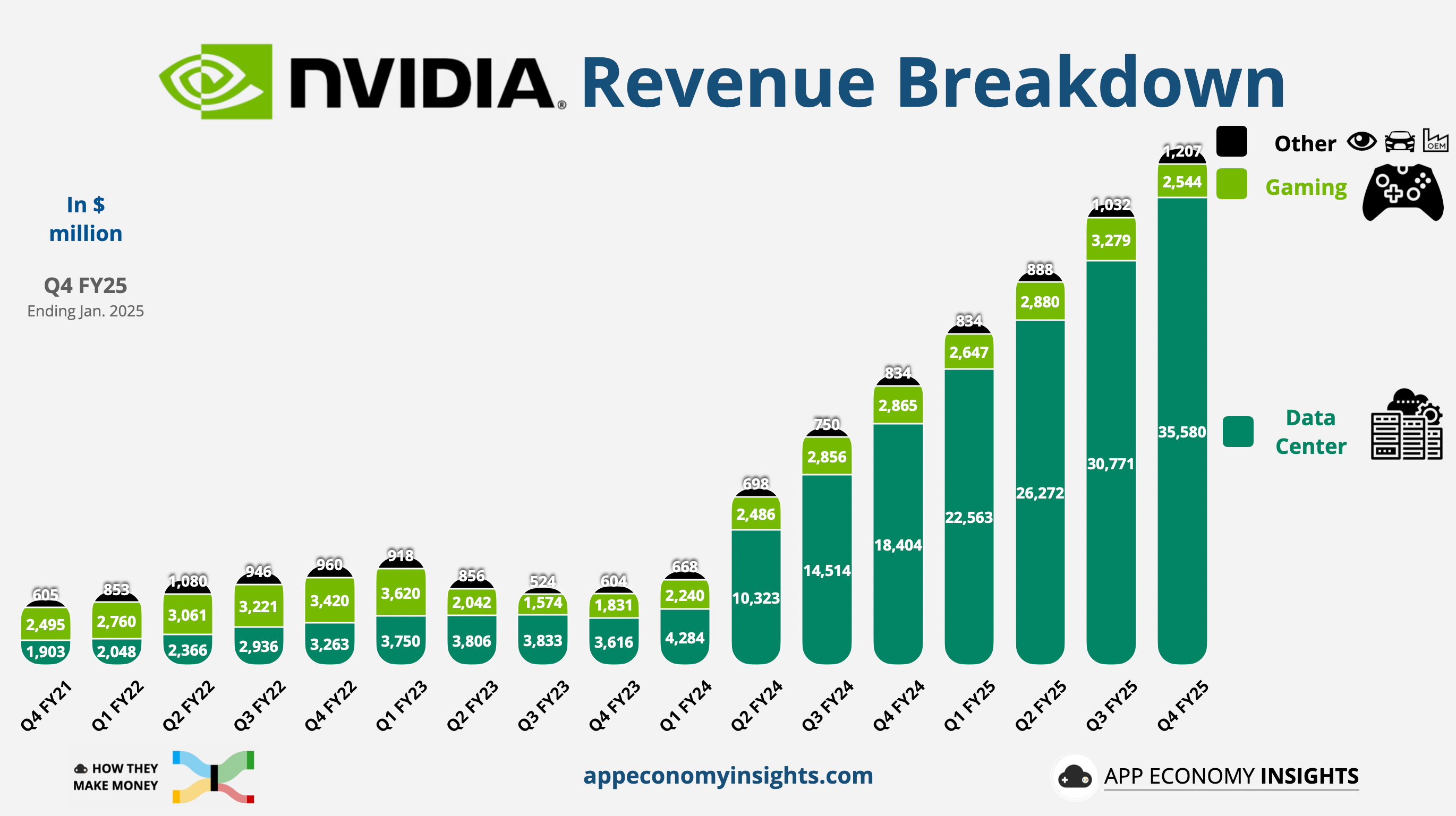

It has been difficult to determine exactly what's happening with availability and pricing, but the feedback from retailers has been consistent: supply is far too low (let's not forget Nvidia makes a ton more money from AI now).

Graph by App Economy Insights

This contradicts Nvidia's official statements, where they claim supply is actually strong and that they've shipped large volumes of cards – just that demand is exceptionally high. So what's really going on? Our take is that Nvidia's statement is misleading.

They claim that in the first few weeks since the 50 series launch, they have shipped twice as many units as they did during the same period for the 40 series. Except there's a big elephant in the data here: with the 40 series, Nvidia launched the RTX 4090 on October 2022, followed by the RTX 4080 a month later. It wasn't until January 2023 – nearly three months later – that the RTX 4070 Ti was released. In contrast, with the 50 series, Nvidia released four models within five weeks.

So when looking at the first 4 – 5 weeks of sales, the RTX 40 series launch included only the 4090 and, for about a week, the 4080. But with the 50 series we have the 5090, 5080, 5070 Ti and 5070 – Nvidia are claiming all four of those models combined reach 2x the shipments of mostly the 4090. Is that supposed to be impressive?

Retailers – at least here in Australia – have told us that compared to the 40 series launch, they received fewer 50 series models, especially when comparing the RTX 5090 to the RTX 4090. The model in highest supply has been the RTX 5080, with availability similar to the RTX 4080 Super, but the other models have fallen short of 40 series launch volumes. While combined 50 series shipments may exceed those of the 4090 alone, that's hardly an apples-to-apples comparison.

Retailers are also reporting higher-than-expected demand, even for models that weren't reviewed particularly well, which has contributed to shortages. Some of this demand could stem from what we discussed earlier – many gamers have been unable to buy even last-gen models for months leading up to these launches. Others may have skipped the 40 series and waited for an upgrade now that the 50 series has arrived.

We are pretty confident supply has been inadequate, even for a launch that hasn't seen overwhelming demand.

Other (potentially bigger) factors to consider

Granted, there are silicon supply side considerations that potentially explain the lack of volume in shipments. These include Nvidia prioritizing TSMC 4N wafers for higher-margin server and workstation products and constraints with GDDR7 memory. There have also been rumors of production issues with the RTX 5070, in addition to the missing ROPs situation for other models.

However, we have not been able to confirm whether the 5070's launch supply was directly affected by production issues. At the very least, the RTX 5070 Founders Edition from Nvidia won't be available until later this month, which is curious, to say the least.

For the GeForce RTX 5070 Ti in particular, low supply could be explained by its die configuration. It uses the same GB203 die as the RTX 5080, along with the same 16GB memory capacity, built on a now-mature TSMC node with good yields. The cost to manufacture a 5070 Ti is likely not much different from a 5080, and there won't be many defective dies available for lower-tier cards.

If Nvidia is waiting for defective silicon, supply will be constrained, leading them to prioritize the 5080 instead. We've been told that 5080 supply is significantly stronger than the 5070 Ti. On top of that, there would be little incentive to sell the 5070 Ti at its $750 MSRP if it costs nearly the same to produce as the $1,000 5080.

On the more shady front, we've heard rumors of backchannel dealings in which Nvidia GPUs are being sold directly to exporters, potentially through Singapore to China – sometimes referred to as the "Singapore loophole."

Recently, three men were charged with fraud in Singapore for illegally transferring Nvidia AI GPUs to China, though that case specifically involved server-grade hardware rather than gaming GPUs. However, Blackwell cards like the RTX 5090 are also attractive for AI workloads, and there are whispers that 5090 supply is being diverted from the gaming market to AI companies.

We're not suggesting Nvidia itself is involved, but rather that certain players in the supply chain may be exploiting this situation. This could help explain why RTX 5090s have been so difficult to find and why prices remain so inflated. Allegedly, exporters are willing to pay far above list price for a 5090, driving up prices in the gaming market and reducing supply. However, this wouldn't affect supply for lower-end cards that lack AI demand.

These factors primarily explain the supply issues, but they don't fully account for the extreme pricing. We have no concrete evidence for why, when supply does arrive, pricing remains excessively high. Our best guess is that this is simply scalping enabled by low supply, with Nvidia doing little to prevent it. AIBs know supply is limited, so they are pricing custom models well above MSRP, and Nvidia is not incentivizing the production of MSRP models. Most restocks have consisted of expensive premium models, especially for the highest-tier Blackwell GPUs.

It's worth noting that in some countries, it is illegal for Nvidia to force AIBs to sell products at a specific price. Nvidia can set the price of Founders Edition cards, but they cannot require AIBs to sell their models at MSRP. However, this does not mean Nvidia is powerless – they could encourage MSRP pricing through other means, such as adjusting GPU quotas for AIBs that fail to meet base pricing, selling GPUs at a cost that actually allows for MSRP pricing, or producing more Founders Edition cards to anchor pricing. Nvidia, however, does not seem particularly interested in doing this. Of course, there is a delicate balance – producing too many Founders Edition cards could upset AIB partners, who are responsible for the bulk of GPU production.

One of the most suspicious and difficult-to-explain aspects of the current pricing situation is the massive jump in price from base models to the next tier up. For the RTX 5070 Ti, base models are listed at $750, but the next step up is $900 for a mid-range OC model. The RTX 5080 jumps from $1,000 to $1,200 or even $1,300. The RTX 5090 quickly climbs to $2,600 and is essentially unavailable. None of this can be attributed to selective rebates like with AMD products, since Nvidia announced prices before cards were shipped to retailers – meaning the advertised price should reflect the cost retailers and AIBs paid for the GPUs.

Is Nvidia controlling supply to keep prices high for as long as possible? It's certainly one possible explanation. It might make sense for the high-end 5080 and 5090, but for the RTX 5070 Ti, which faces real competition from AMD, artificially inflating prices would be counterproductive.

The one exception to these extreme price hikes is the RTX 5070. It moves from $550 for base MSRP models to around $600 for the next step up – for example, upgrading from a Gigabyte Windforce to a Gigabyte Eagle.

At this point, it's clear that the RTX 5080 and RTX 5090 have a fake MSRP – you simply aren't buying those GPUs at $1,000 and $2,000

At this point, it's clear that the RTX 5080 and RTX 5090 have a fake MSRP – you simply aren't buying those GPUs at $1,000 and $2,000. Most shipments to retailers consist of premium models, available in limited quantities at inflated prices. For example, in the most recent RTX 5080 restock at PC Case Gear, the cheapest model was the Asus Prime at $2,600 AUD – 29% over MSRP, equivalent to $1,500. The rest of the models were even more disgustingly expensive high-end variants.

The RTX 5070 Ti is basically at that point now, too. Just three weeks after launch, supply is very limited, and its MSRP is effectively meaningless. The RTX 5070 remains a wait-and-see situation, though in Australia, at least one MSRP model is available for pre-order with an ETA next week – more promising than anything we've seen for the other 50-series cards.

The state of the market

In summary, the GPU market right now is screwed up, and there's a multitude of factors at play: the premature discontinuation of older models, delays in the new generation, poor supply for Nvidia's RTX 50 series leading to scalping, rebate issues with Radeon cards, overwhelming GPU demand due to AI, sneaky exporting, and even tariffs have all played a role.

It's incredibly difficult to buy a GPU at a reasonable price, and we strongly encourage waiting for better deals instead of purchasing at inflated prices.

Will things get better? There are reasons to believe they will. Competition is heating up, particularly in the upper mid-range, which should eventually lead to price adjustments as supply stabilizes.

AMD has every reason to keep flooding the market with Radeon 9070 XTs, and if that happens, it will be difficult to maintain high 9070 XT prices. In turn, this would make it even harder for Nvidia and its partners to justify keeping the 5070 Ti at $900 (or simply give up on that segment, which would directly benefit AMD). The high-end GPU market could remain problematic for longer, but for the more recent releases, we are still in the early stages.

If we check back a month or two from now and prices remain absurdly high, that will be a major red flag. As always, we will continue monitoring the GPU market and holding companies accountable in the coming months.

Coming up soon on TechSpot (as soon as next week), we'll publish a GPU cost per frame value comparison, analyzing gaming performance against real-world pricing in multiple regions. This should provide a clear picture of which models offer the best value to gamers right now. We also have a few ideas for better tracking real-world pricing trends, and we'll keep that data updated throughout the year. Stay tuned.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

:quality(85):upscale()/2025/03/13/764/n/1922729/4c26cfa167d313d93a57b8.85428907_.webp)

:quality(85):upscale()/2025/03/12/103/n/1922153/5e6cd9bf67d234e03b5bf6.14130631_.png)

:quality(85):upscale()/2024/01/29/984/n/1922153/3153712665b828a277d2c6.55118005_.jpg)

:quality(85):upscale()/2024/11/22/933/n/24155406/398759ae6740f663d755c4.12400021_.png)