Resolution to kill IRS DeFi broker rule heads to Trump’s desk

US President Donald Trump is expected to sign off on a resolution undoing a rule that requires DeFi protocols to report to US tax authorities.

Update (March 27, 3:03 am UTC): This article has been updated to add background and information on the resolution.

US President Donald Trump is expected to sign a resolution to kill a Biden administration-era rule that requires decentralized finance (DeFi) protocols to report to the Internal Revenue Service after the legislation passed the Senate on March 26.

The Senate voted 70-28 to pass a motion repealing the so-called IRS DeFi broker rule that aimed to expand existing IRS reporting requirements to crypto.

The Senate passed a version of the resolution in early March, but the House made its own version due to Constitutional rules about where budget measures should originate.

The House passed its copycat version on March 11, which sent it to the Senate for a final vote before it could be sent to Trump. The Senate was widely expected to pass the resolution. Source: DeFi Education Fund

The White House’s AI and crypto czar, David Sacks, has said Trump supports killing the rule.

The rule would aim to require DeFi platforms, such as decentralized exchanges, to file their gross proceeds from crypto sales and include information on those involved in the transactions.

Related: Crypto regulation must go through Congress for lasting change — Wiley Nickel

Critics of the rule have claimed it would lump decentralized platforms with too onerous rules, which would hamper innovation in crypto and DeFi.

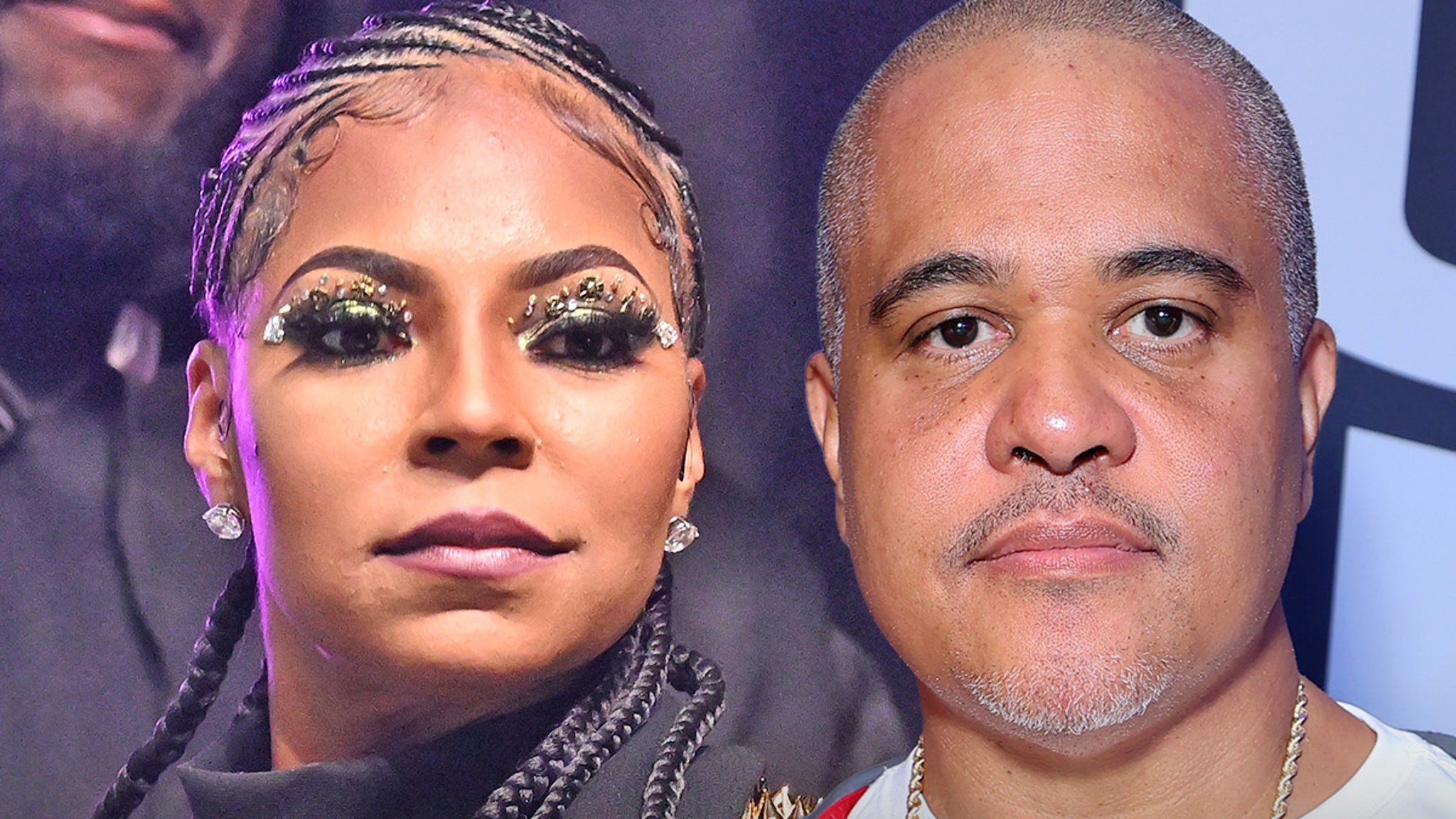

Blockchain Association CEO Kristin Smith applauded the Senate vote in a statement, saying the advocacy group looked forward “to taking this harmful rule off the books for good.”

Eli Cohen, general counsel of the RWA tokenizing platform Centrifuge, said in a statement to Cointelegraph earlier in March that the rule never made “any sense and was unworkable in practice.”

Those opposing the resolution included Democratic Representative Lloyd Doggett, who said before the House’s vote earlier this month that it was a “special interest exemption” from IRS disclosures, which “makes tax evasion and money laundering so much easier for wealthy Republican donors who have been using these decentralized exchanges.”

He claimed killing the rule would create a “loophole that would be exploited by wealthy tax cheats, drug traffickers and terrorist financiers.”

Magazine: Best and worst countries for crypto taxes — Plus crypto tax tips

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.jpg?mbid=social_retweet)