Qualcomm’s Ventana acquisition points to a long-term RISC-V strategy to complement its Arm lineup

Qualcomm has acquired Ventana Micro Systems, a RISC-V CPU specialist whose engineers have spent several years pushing the open instruction set toward high-performance server and edge designs. The deal brings Ventana’s core CPU talent in-house just as Qualcomm is broadening its compute ambitions well beyond smartphones, balancing Arm-based designs with a growing interest in RISC-V as AI continues to disrupt, well, everything.

Qualcomm is in the middle of expanding Oryon, its custom CPU architecture that debuted in Snapdragon X Elite and underpins its push into data center accelerators, Windows PCs, and automotive compute platforms. Adding Ventana gives Qualcomm direct access to a mature RISC-V design team, rather than relying solely on internal experimentation or third-party IP, and it does so as customers across all markets are asking questions about long-term architectural flexibility.

RISC-V as a hedge

Qualcomm executives have said publicly that the company is capable of building high-performance CPUs on RISC-V if it chooses to do so. The Ventana acquisition turns that assertion into reality, as the company’s work has focused on scalable, out-of-order RISC-V cores with features expected in enterprise-class CPUs, including coherent interconnects and virtualization support. Folding that expertise into Qualcomm reduces the friction of turning RISC-V from a research effort into a deployment-ready option.

None of this is to say that Qualcomm is abandoning Arm, though. The duo’s relationship remains central to its smartphone and PC businesses, and Arm-based cores will continue to dominate shipping volumes in the near term, but roadmap alignment and geopolitical risk have become more visible considerations for large chipmakers. RISC-V offers a way to diversify architectural exposure without committing to a clean break, something that, for Qualcomm, offers value even if RISC-V volumes ramp gradually.

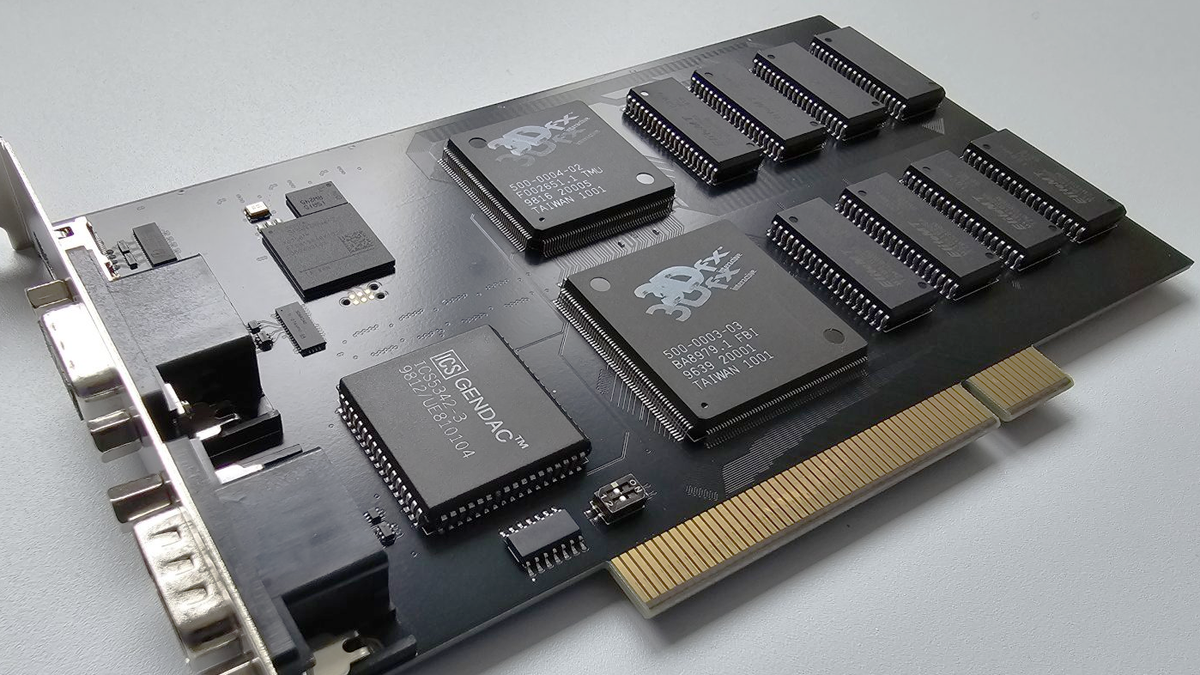

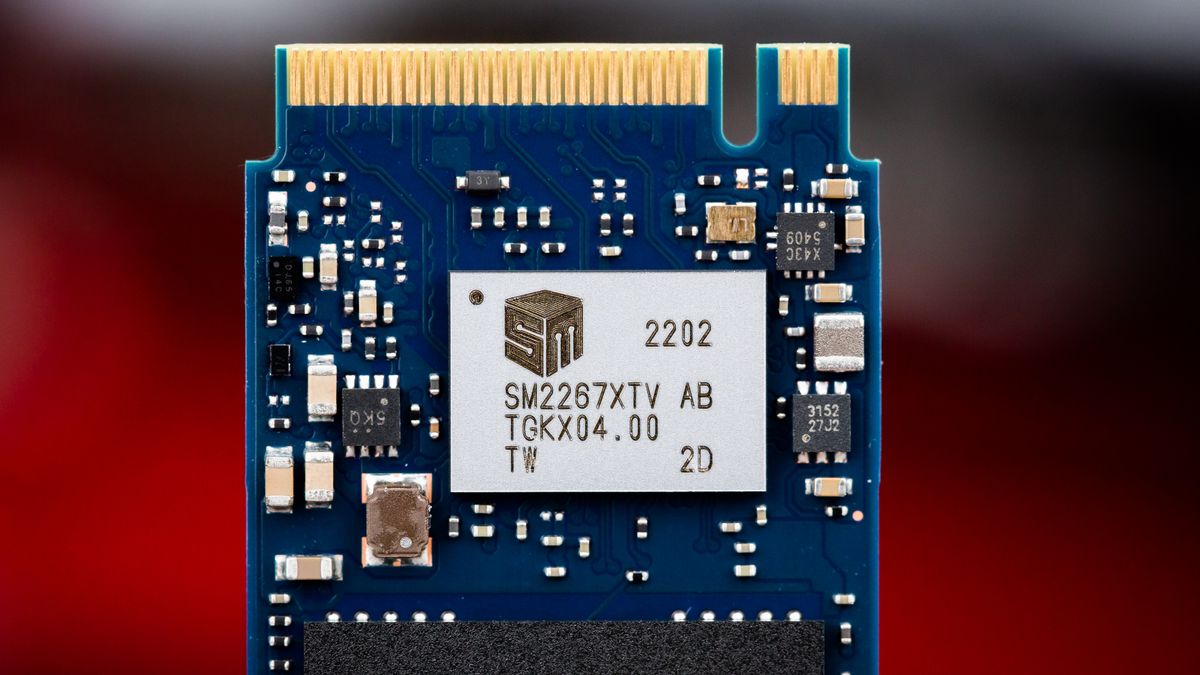

Ultimately, RISC-V has moved past its early microcontroller roots and is now entrenched in storage controllers, networking gear, industrial controllers, and an increasing share of automotive silicon. Competition within the ecosystem is intensifying as major vendors seek influence over extensions, toolchains, and software support. Owning a credible in-house CPU team gives Qualcomm leverage in those conversations and reduces dependence on external roadmaps.

Industrial and automotive momentum

Outside consumer devices, RISC-V is becoming mainstream in areas that value long product lifecycles and architectural stability, like industrial control systems and embedded platforms. Qualcomm has been expanding its presence in these markets through its IoT and industrial compute groups, and deeper RISC-V capabilities will help it compete against vendors that already ship large volumes of RISC-V silicon.

The automotive sector is following a similar trajectory, with software-defined vehicles driving consolidation of compute functions into centralized platforms. Automakers in particular are increasingly sensitive to licensing costs and supply chain risk — as we saw during the chip shortage of 2020 to 2023, and more recently with the Nexperia-China drama — which is leading them to prepare RISC-V-based compute platforms for systems like infotainment and ADAS.

Speaking of China, customers in the region who are facing uncertainty around access to certain Arm-based products have become more receptive to RISC-V as a neutral alternative. That demand shift has contributed to a rapid increase in RISC-V investment and product development across the region. While Qualcomm does not need to tailor products exclusively for China to benefit from that momentum, having strong RISC-V capabilities lowers barriers to participation in markets where openness and local control are being increasingly prioritized.

Where Oryon and AI intersect

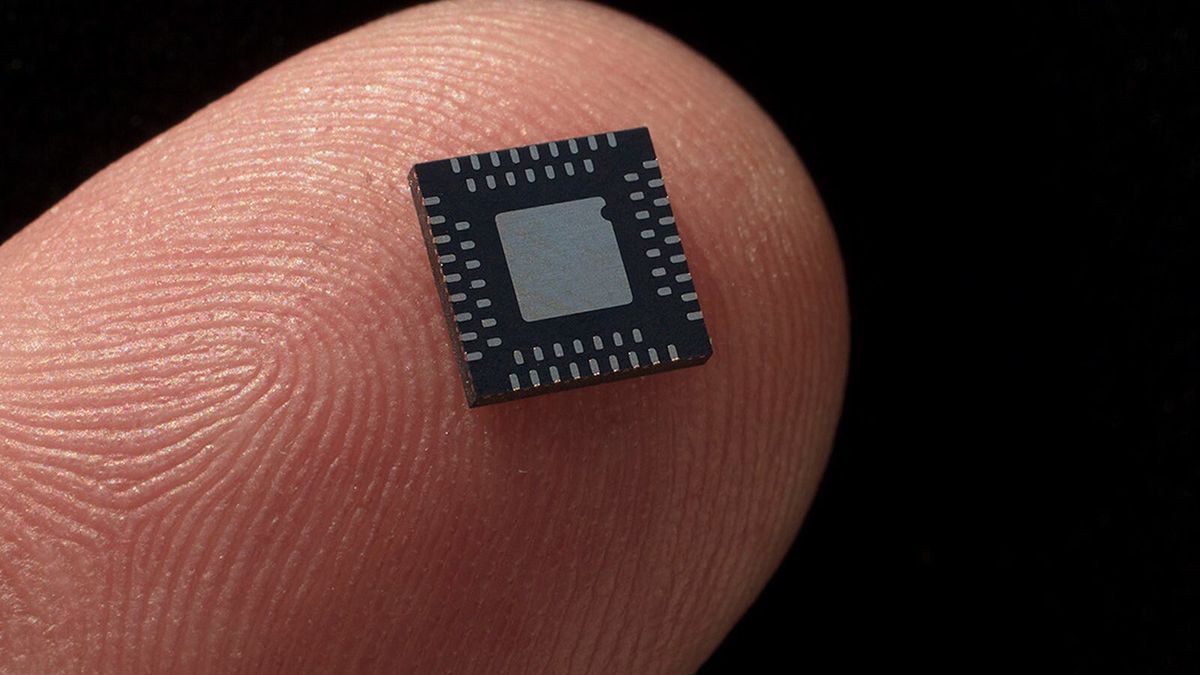

One of the more interesting implications of the deal is the intersection of RISC-V flexibility and AI workloads. As AI inference spreads across edge and embedded devices, the line between CPU, GPU, and NPU responsibilities is blurring. In certain classes of workloads, especially control-heavy or sparsely parallel tasks, a well-designed CPU can approach accelerator-class efficiency when paired with the right extensions and memory architecture.

RISC-V’s modularity makes it very attractive in this context, with custom extensions allowing vendors to tailor cores for specific inference patterns without waiting for standardization cycles. Qualcomm’s Oryon CPUs are already positioned as high-performance general-purpose cores optimized for AI-adjacent workloads. Integrating Ventana’s RISC-V expertise creates room for parallel exploration, where RISC-V designs could complement Oryon in products that prioritize consolidation of compute over raw peak throughput.

This does not imply that Qualcomm plans to replace NPUs with RISC-V CPUs, or to collapse its architecture stack into a single design. Instead, it reflects a broader industry trend toward heterogeneous compute, where CPUs, GPUs, and accelerators are selected based on workload characteristics. Having both Oryon and RISC-V options will give Qualcomm more freedom to potentially tune that mix across product categories.

A maturing ecosystem

Skepticism around RISC-V has often centered on ecosystem maturity, particularly software and tooling, but that argument is becoming harder to sustain. RISC-V is now present across cloud and edge computing, and while mass-market consumer devices remain dominated by Arm and x86, many emerging application domains already include RISC-V deployments. Toolchains and OS support have improved substantially, driven by commercial demand, but they still remain behind what’s available for Arm and x86.

Qualcomm’s decision to acquire Ventana, however, fits nicely within RISC-V’s general upward trajectory, apparently timed to coincide with expanding addressable markets and a clearer picture of customer demand. Ventana’s team brings immediate engineering expertise, while Qualcomm provides scale, manufacturing access, and integration experience across multiple industries.

In that sense, the acquisition can be seen as Qualcomm preparing for the inevitable and ongoing reshaping of compute requirements by AI. Customers will seek greater control over their silicon roadmaps in response, making architectural flexibility a competitive offering. By deepening its RISC-V capabilities while continuing to invest in Oryon and Arm-based designs, it appears that Qualcomm hopes to pivot around that transition with fewer bottlenecks.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

:quality(85):upscale()/2025/11/10/782/n/49351757/8170ecd6691224df8bd1d7.49547606_.png)

:quality(85):upscale()/2025/11/21/894/n/24155406/f08298fe6920cb78a61ca3.64427622_.jpg)

:quality(85):upscale()/2025/10/31/699/n/24155406/907a28006904d9f5870b34.67078517_.png)

:quality(85):upscale()/2025/11/26/724/n/1922153/364868b6692729990f9002.05869709_.png)