TSMC and Foxconn hit hard in Taiwan following Trump's tariffs announcement

Taiwan's stock market plunged nearly 10% on Monday, its steepest single-day decline ever, following U.S. announcement of a 32% import duty on goods from Taiwan, as well as Trump's intention to apply tariffs on chips. The slide was fueled by investor panic and heavy selling of major high-tech firms, including TSMC and Foxconn, Reuters reports.

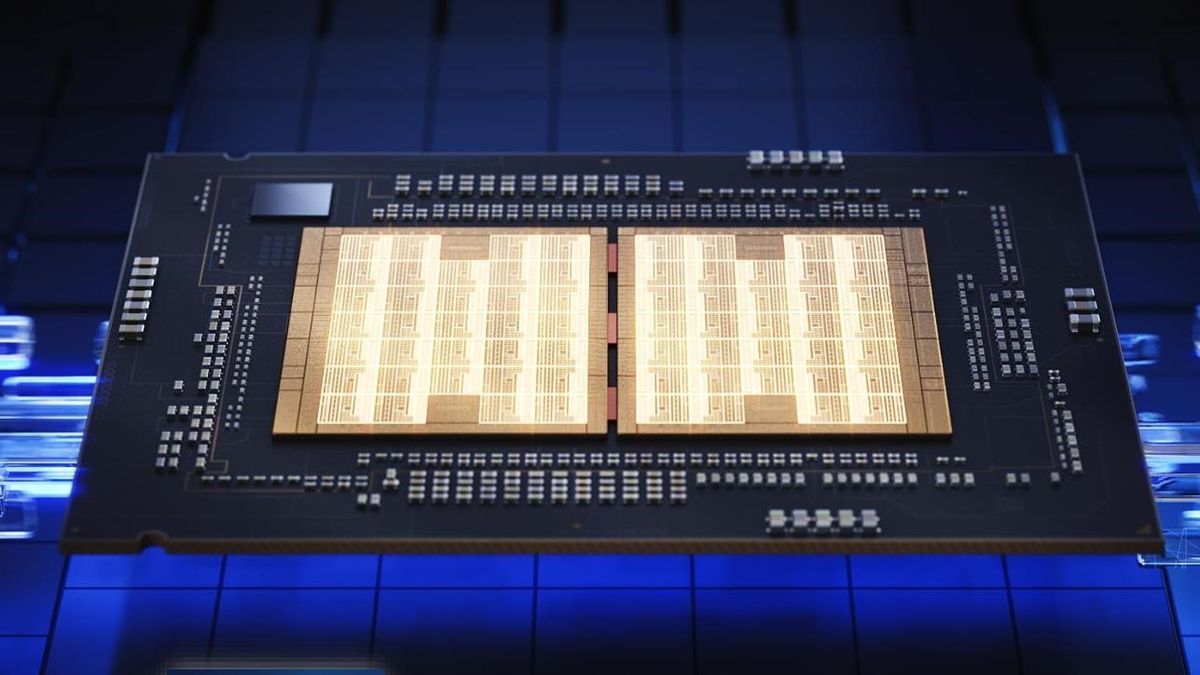

Losses of TSMC and Foxconn highlight how deeply Taiwan's economy is tied to technology and global exports. The collapse followed a new round of U.S. duties, including a 32% charge on goods from Taiwan. TSMC and Foxconn were hit especially hard. Each saw share prices drop close to the daily 10% limit, triggering automatic halts.

Foxconn assembles consumer electronics for Apple (including iPhones, MacBooks, and iPads) as well as AI servers for some of the most significant cloud service providers. With a 32% tariff on goods produced in Taiwan, a 54% tariff on items made in China, Foxconn's profits are at risk.

The situation is more complex for TSMC. For now, tariffs are not imposed on semiconductors, but TSMC-made chips are ubiquitous, so if sales of consumer electronics and AI servers drop, TSMC's revenues and profits will decline too. Also, once tariffs on chips come into effect, TSMC, UMC, and other Taiwanese chipmakers will get hurt even more.

Taiwan's government responded quickly. A relief fund worth about $2.65 billion was rolled out to help businesses affected by the new trade rules. Taiwan's National Stabilisation Fund, which controls NT$500 billion ($15,164 billion) in assets, said it might step in to calm the market. Temporary restrictions were also placed on short-selling to limit volatility.

President Lai Ching-te addressed the situation by pledging stronger economic ties with the U.S. He promised increased imports from America and efforts toward eliminating tariffs altogether. Writing on X, he made clear there would be no countermeasures, emphasizing a joint path to economic growth and stability.

Financial experts warned of long-term risks. Analysts described the selling as panic-driven and flagged a potential recession with odds exceeding 50% if conditions worsen. Goldman Sachs lowered Taiwan’s rating to 'underweight' in its Asia outlook, pointing to the country's strong reliance on U.S. exports and heightened market sensitivity.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

:quality(85):upscale()/2025/04/04/906/n/1922153/36cdb2db67f0450a7697e9.58921428_.png)

:quality(85):upscale()/2025/04/04/774/n/1922153/4a9da8ef67f018411c24b9.24012932_.jpg)

:quality(85):upscale()/2025/04/04/858/n/49352476/1fe3cc4967f034ad6307f5.02927466_.jpg)

:quality(85):upscale()/2024/07/01/865/n/1922794/31b34f5c6683079fafdc56.00956289_.png)