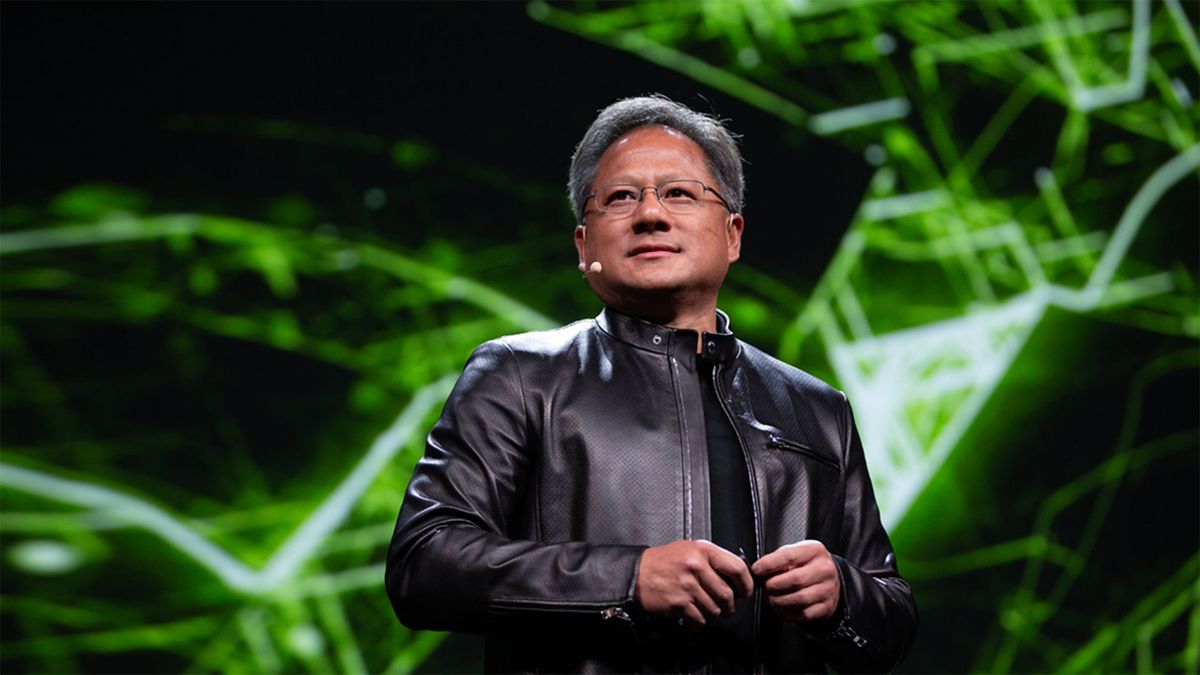

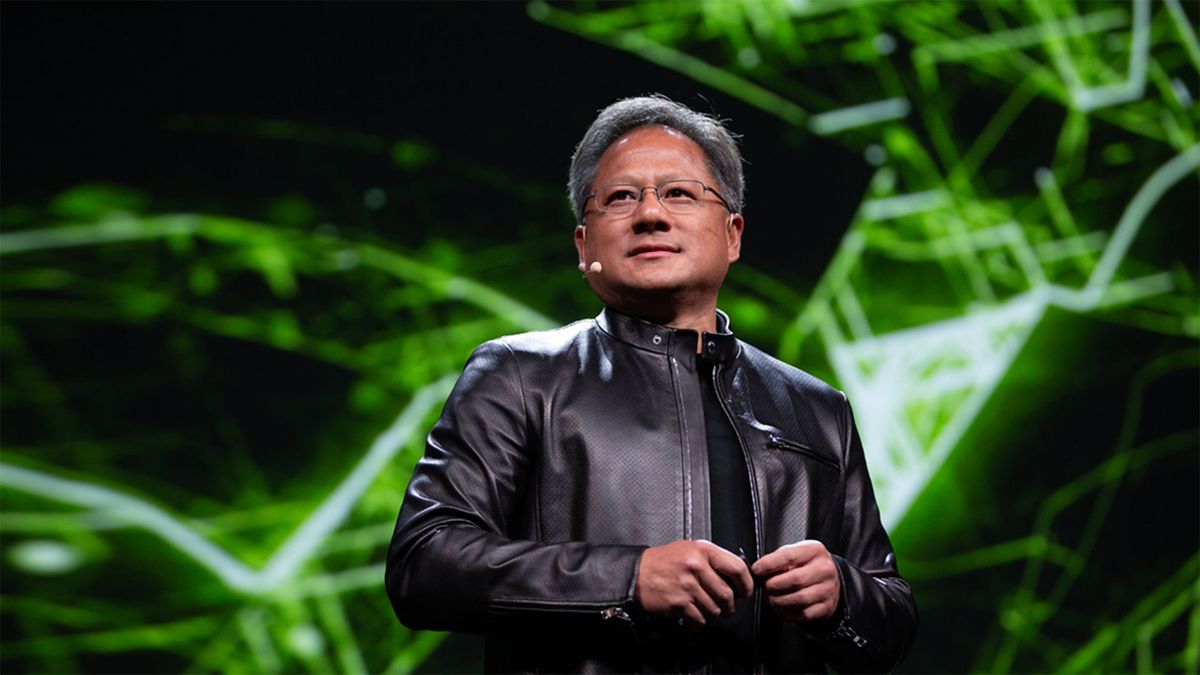

Nvidia CEO denies being approached for stake in Intel Foundry, casting doubt on consortium reports — TSMC board member also denies involvement

Jensen Huang, chief executive of Nvidia, stated that his company had not been approached to participate in a group effort to acquire a stake in a company that would operate Intel's foundry unit. He dismissed claims that Nvidia was working with industry peers and TSMC on such a deal at a press conference at GTC, reports Reuters.

Separately, Paul Liu, a TSMC board member and the head of Taiwan's National Development Council, denied claims that the company is considering purchasing Intel's struggling foundry unit, reports DigiTimes.

"Nobody has invited us to a consortium," Huang said, according to Reuters. "Nobody invited me. Maybe other people are involved, but I do not know. There might be a party. I was not invited."

While speaking to Taiwan's Legislative Yuan Economic Committee on March 19, Paul Liu stated that the acquisition of Intel Foundry has never been discussed at the board level and compared it to mixing two incompatible substances, something that one in the semiconductor industry can consider both figuratively as Intel and TSMC have vastly different corporate cultures and literally as the two companies use different chemical substances for manufacturing. As a result, industry experts believe such an acquisition would be more harmful than beneficial to TSMC.

Liu explained that stabilizing the company's most advanced production technologies already takes between 18 and 24 months. Exporting such a node to the the U.S. would add another year, making American operations three years behind those in Taiwan, according to Liu. He also addressed concerns about a possible second Trump presidency leading to a shift of Taiwan's semiconductor industry to the U.S., urging lawmakers to see the U.S. as a partner (which accounts for the lion's share of TSMC's revenue) rather than a competitor.

Earlier this year there were rumors that the U.S. government pushed TSMC to take over Intel Foundry and operate it. The plan involves Intel spinning off its Intel Foundry unit, which makes chips for itself and external clients. TSMC would acquire less than half of the new entity, while the remaining shares would go to industry partners. The list of industry partners included AMD, Broadcom, Nvidia, and Qualcomm, according to Reuters. However, speaking at the conference, Huang denied any involvement in discussions about a potential consortium to take control of Intel's fabs.

For Nvidia, which produces billions of dollars worth wafers every year, a dual sourcing supply strategy could make sense. However, designing large AI/HPC GPUs for different process technologies used by Intel and TSMC would significantly affect Nvidia's costs. Investing in a fab joint venture would also be odd for the company, which started as — and remains — a fabless chip designer.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The talks reportedly started before TSMC's March 3 announcement of its $100 billion U.S. investment. This plan includes five additional Fab 21 modules, two advanced packaging facilities, and a research center. However, according to Reuters' own report, the conversations about the fab joint venture continued after the announcement as TSMC was seeking agreements with major fabless chip design companies. As a result, Taiwanese lawmakers raised concerns following such media reports and pressured Liu for clarifications.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

:quality(85):upscale()/2025/03/19/886/n/1922153/a194c07267db2634597568.13666503_.jpg)

:quality(85):upscale()/2023/09/20/931/n/1922729/962b4cce650b624138f360.00007879_.jpg)

:quality(85):upscale()/2023/12/19/987/n/1922441/4559590965821c2a435155.87772300_.jpg)