Micron confirms memory price hikes as AI and data center demand surges

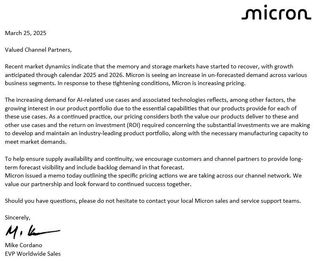

Micron has confirmed its plans to raise memory prices, citing strong demand for DRAM and NAND flash in the years ahead. The company's latest announcement suggests that prices will continue to rise through 2025 and 2026 as supply constraints and growing demand from AI, data centers, and consumer electronics drive up costs.

The price hike comes as the memory market rebounds from a period of oversupply and declining revenues. Over the past year, DRAM and NAND flash prices have steadily recovered due to production cuts by major suppliers and increasing demand for high-performance computing and AI workloads. With Micron confirming its intention to raise prices, other memory manufacturers such as Samsung and SK Hynix are expected to follow suit, further solidifying the upward pricing trend.

In a statement to its channel partners, Micron cited "un-forecasted demand across various business segments" as a key factor behind the price increase. The company highlighted the increasing demand for AI-related applications and the necessity of maintaining a competitive product portfolio as drivers for these adjustments. Micron also encouraged partners to provide long-term forecasts to help ensure supply stability in the coming years.

One of the key drivers behind the price increase is the growing demand for high-bandwidth memory (HBM), which is crucial for AI accelerators and next-generation GPUs. As companies like Nvidia, AMD, and Intel push for more advanced AI solutions, the need for faster and more efficient memory solutions has surged. Micron and its competitors are ramping up production of HBM to meet this demand, but supply remains tight, contributing to rising costs.

The company recently announced an investment of $7 billion in a new HBM assembly facility in Singapore, aiming to meet the increased demands driven by AI advancements. The plant is scheduled to commence operations in 2026 and should enhance Micron's capacity to produce HBM3E, HBM4, and HBM4E memory, positioning the company to capture a larger share of the growing HBM market.

Additionally, the broader consumer electronics market is expected to see a resurgence, with PC and smartphone manufacturers increasing orders for DRAM and NAND flash. As device makers prepare for new product launches in late 2025 and 2026, memory demand is projected to remain strong, further justifying Micron's price adjustments.

With Micron setting the stage for a new pricing trend, all eyes are now on how competitors and customers will respond. If demand remains strong, the industry could see sustained price increases, impacting everything from gaming PCs to enterprise data centers in the years ahead.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0